Introduction:

Global events wield immense influence on exchange rates and international trade, largely driven by the political landscape and government policies. While these events can trigger fluctuations in currency values, they also present unique opportunities. In this guide, we explore how individuals and businesses can leverage these situations, understand their influence on financial markets, and make strategic decisions to prosper. Let’s unveil strategies to ensure financial well-being in an ever-changing global economy, fully optimized for SEO and mobile-friendliness.

Section 1: Politics and Exchange Rates

Political events, shifts in leadership, or geopolitical tensions can significantly impact currency values. Changes in governments or political instability can erode investor confidence, leading to currency depreciation. Additionally, political decisions can lead to trade barriers, impacting international trade. However, positive developments, like free trade agreements, can foster economic growth. Staying informed about global politics empowers individuals and businesses to capitalize on emerging trends and shape favorable policies.

Section 2: Unforeseen Consequences: Recessions and Economic Downturns

Global events can lead to recessions, impacting employment, consumer spending, and investment portfolios. Job losses and reduced consumer spending create economic contraction. While downturns may seem challenging, they also present investment opportunities. Savvy investors can identify undervalued assets, positioning themselves for substantial returns during the recovery.

Section 3: Mitigating the Impact: Strategies for Individuals and Businesses

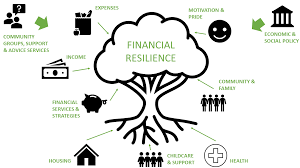

To navigate global uncertainty, individuals and businesses can adopt various strategies. Building an emergency fund provides financial stability during economic downturns. Diversification, spreading investments across different asset classes, mitigates risk and supports long-term growth. Embracing innovation and adaptability helps businesses remain competitive. Challenging times offer opportunities for growth, and these strategies can help individuals and businesses thrive.

Section 4: The Importance of Diversification in Times of Global Uncertainty

Diversification is a vital strategy for financial resilience. It minimizes risk by spreading investments across asset classes, regions, and industries. Just as a well-diversified garden is resilient to pests, a diversified financial portfolio withstands economic shocks. It promotes resilience by reducing dependence on a single market or sector and allows investors to capitalize on various economic cycles and opportunities. Embrace diversification to foster adaptability and resilience amidst global uncertainty.

Conclusion:

In a world of global events, these strategies empower individuals and businesses to prosper. The interconnectedness of our world may bring challenges, but it also offers opportunities for growth and success. By adopting diversification, staying informed about market trends, and embracing innovation, individuals and businesses can navigate market fluctuations and emerge stronger amidst global uncertainties. Optimism and adaptability lead the way to a brighter financial landscape.